Discover a cosigner with outstanding credit rating. Their wonderful credit rating will offset you terrible credit, so you're able to qualify for an improved loan in a lessen desire charge.

It may be doable to qualify faster if you were being forced into bankruptcy for good reasons past your control, but early approval is unusual.

We are trying to find attorney matches in your town. You should inform us how they could get in contact for your session. There was an issue Using the submission. Make sure you refresh the page and try again

Bankruptcy is one debt reduction selection among lots of. Before you decide how you can progress, it’s vital to comprehend the rapid results of trying to get bankruptcy safety. After your filing is approved, the courtroom prohibits creditors from having collection actions versus you. This “computerized continue to be” signifies that you’ll be legally protected towards harassing telephone phone calls, wage garnishment, provider cutoffs and various creditor actions till the situation is fixed.

Get Forbes Advisor’s ratings of the greatest lending platforms and helpful information on How to define the top mortgage depending on your credit score score.

Unsecured financial loans are riskier than their secured counterparts because the lender can’t seize a private asset to recoup its losses in the case you are unsuccessful to repay your mortgage. For that reason, you could possibly see that read here lenders are more likely to approve you for any secured mortgage after bankruptcy.

Consenting to those technologies will permit us to course of action information for instance browsing behavior or special IDs on this site. Not consenting or withdrawing consent, could adversely have an effect on specific options and features.

But, a rise in the amount of problems from SoFi shoppers that explain damaging experiences - precisely throughout the image source customer service department - gave us some cause for worry.

Of course, auto bank loan lenders don’t exclude whoever has gone through bankruptcy. Nevertheless, you’ll shell out increased desire you could try here premiums in case you finance the motor vehicle after receiving a bankruptcy discharge.

To increase your odds of qualifying for a private loan after bankruptcy, understand what components lenders look at when examining your application.

One particular solution: Assist on your own out by acquiring a free of charge copy of your respective credit report and examining it carefully for glitches so visit the site they are often taken out.

National Debt Relief operates tricky to ascertain what fiscal possibility will operate finest for every specific purchaser. A high BBB rating, Skilled staff members, and also a shopper pleasure ensure pushes Countrywide Financial debt

A relatives small business Launched in 2008, WeFixMoney has maintained the very best expectations in customer service and safety for a decade. Our mission is that can help solve your short-term funding index requires and we will never use your data for some other objective.

This lets you increase your credit score rating as much as you possibly can before you decide to apply for a personal loan. Try to remember, improved credit rating not only means that it’s much easier to get authorised. You furthermore may get a better fascination charge, meaning significantly less interest paid around the everyday living of your mortgage.

Richard "Little Hercules" Sandrak Then & Now!

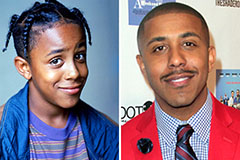

Richard "Little Hercules" Sandrak Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Shane West Then & Now!

Shane West Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now!